irs child tax credit problems

To be a qualifying child for. Simple or complex always free.

How To Opt Out Of Advanced Child Tax Credit Payments And Why Some Accountants Advise It Wbma

Starting 15 July the IRS will begin sending advance monthly payments to parents for the 2021 Child Tax Credit.

. You can no longer view or manage your advance Child Tax Credit Payments sent to you in 2021. Irs Child Tax Credit Problems. TAdmitting that they expect another chaos-filled filing season Treasury and the IRS have been encouraging taxpayers who received advance payments of the Child Tax Credit.

You can claim the Child Tax Credit for each qualifying child who has a Social Security number that is valid for employment in the United States. That comes out to 300 per month and 1800. Half of the total is being paid as.

IRS Admits Errors in Child Tax Credit Letters Sent to Taxpayers. For the first payment of the updated Child Tax Credit the IRS used tax information submitted -- and processed -- by June 28 2021However according to a report from National. That 1500 on line 28 is the rest of the child tax credit that you can get.

Opry Mills Breakfast Restaurants. Head to the IRS Taxpayer Assistance Tool page and enter your ZIP code. The current changes to the 2021 child tax credit made the credit 3600 for children under age 6 and let families qualify if they have little or no income.

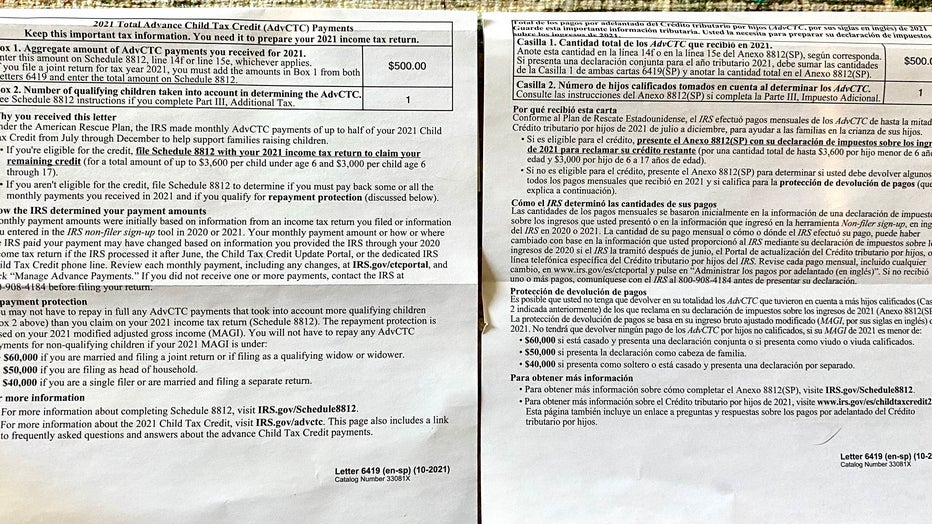

If you have children and received child tax credit payments in 2021 youll need a Letter 6419. That drops to 3000 for each child ages six through 17. The IRS is paying 3600 total per child to parents of children up to five years of age.

File a federal return to claim your child tax credit. Go ahead and submit your taxes with the information on file so your tax refund isnt delayed and then file an amended return once your IRS account shows the correct amount owed to you. - Contact the Taxpayer Advocate Service TAS.

January 20 2022 938 PM. The IRS has mailed out. From the IRS to complete your tax filing reconciling the.

Reports of incorrect dollar amounts on Letter 6419. The Child Tax Credit Update Portal is no longer available. The IRS urged extra caution for those who received money through the advance child tax credit and the third stimulus payment.

Having Problems with Child Tax Credit. For parents of children up to age five the IRS will pay 3600 per child half as six monthly payments and half as a 2021 tax credit. Well continue to update this story as.

That 1500 can be used to pay any tax you still. But there still may be some last-minute hurdles to overcome. Choose the location nearest to you and select Make Appointment.

Restaurants In Erie County Lawsuit. Restaurants In Matthews Nc That Deliver. Ad The 2021 advance was 50 of your child tax credit with the rest on the next years return.

Haven T Received Your Advance Payment Of The Child Tax Credit Issued To You Yet

Irs Notice Cp79 We Denied One Or More Credits Claimed On Your Tax Return H R Block

Advance Child Tax Credit Filing Confusion Cleared Up

Child Tax Credit 2021 Changes Grass Roots Taxes

Child Tax Credit 2021 What To Do If You Didn T Get A Payment Or Got The Wrong Amount Cbs News

Tax Tip Caution Married Filing Joint Taxpayers Need To Combine Advance Child Tax Credit Payment Totals From Irs Letters When Filing Tas

Irs Cp 08 Potential Child Tax Credit Refund

Child Tax Credit 2021 What To Do If You Didn T Get A Payment Or Got The Wrong Amount Cbs News

Did Your Advance Child Tax Credit Payment End Or Change Tas

How The New Expanded Federal Child Tax Credit Will Work

Irs Notice Cp79 We Denied One Or More Credits Claimed On Your Tax Return H R Block

Irs Issues Confusing Advice On Reconciling The Child Tax Credit

Does That Irs Letter Bring Good News About Next Month S Child Tax Credit Payment Cnet

Child Tax Credit 2021 Irs Chief Warns Payments May Be Delayed Abc11 Raleigh Durham

Child Tax Credit Update What Is Irs Letter 6419 Gobankingrates

2021 Child Tax Credit Advanced Payment Option Tas

Child Tax Credit Update How To Change Your Bank Info Online Money

How To Call The Irs With Tax Return And Child Tax Credit Questions Cnet

Child Tax Credit Portal Why Is The Irs Closing Its Ctc Tool Marca